What is Receivables Financing?An easy to understand guideline

Receivables financing (also known as invoice factoring or invoice financing) is a type of financial arrangement in which a company sells its outstanding invoices to financial institutions. Through receivables financing, businesses can receive payment earlier to support their business operations to keep the cash flow up when buyers are slow payers or have extended payment terms.

Why Receivables Financing is Important?

Doing business with positive income are the shared goals of all commercial entities. However, having lots of accounts receivable may be an issue. Accounts receivable is classified as asset in financial report but also refers to outstanding balance to be collected in the future. Some companies perceive accounts receivable as a burden as they cannot convert to cash immediately. What is more, accounts receivable may finally turn into bad debt. As such, some companies may opt for receivables financing to gain instant cash flows for better liquidity and risk dilution.

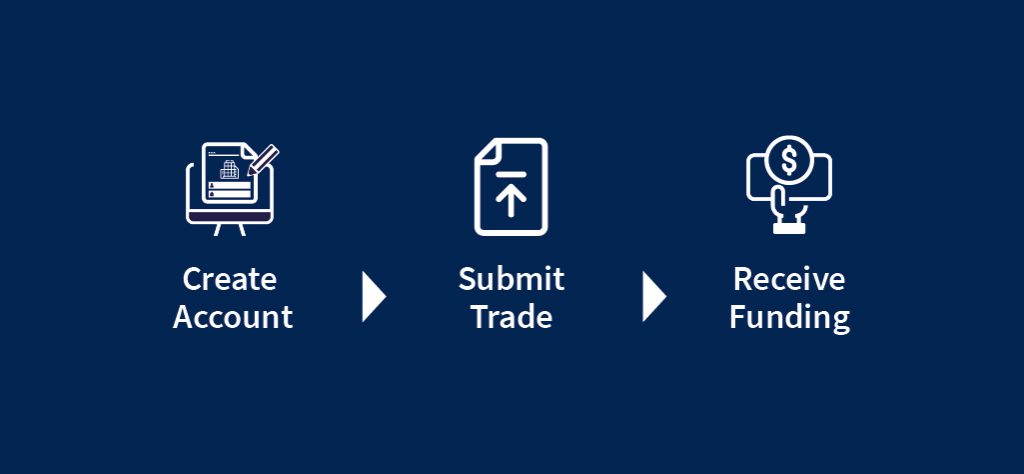

Key steps of receivables financing are illustrated as below:

- Seller sells goods to buyer

- Seller issues an invoice to buyer

- Seller sells the outstanding invoice to financial company/factor

- Financial company/Factor pays a proportionate value of the invoice to seller

- Buyer settle the outstanding invoice payment

- Financial company/Factor sends the remaining balance to seller.

Let’s take a look at the below case for a better illustration of the concept:

The following example illustrates how receivables financing works:

ABC firm sells shower equipment to hotels and club houses. ABC firm receives a purchase order from XYZ Hotel. XYZ Hotel requests for the shower equipment to be delivered within 1 month and it can only pay for the invoice in the next 3 months after the delivery. Under this payment term, ABC firm might face shortage in capital and jeopardising of the firm’s operation. In this case, ABC firm sells its invoice to FundPark to obtain quick cash flow for business growth.

Benefits of Receivables Financing

-

Quick Access to Working Capital

Receivables financing allows businesses to convert accounts receivables to immediate cash flow. Businesses can have better cash flow management as this avoids late payment from buyers. Regardless of your business size, FundPark provides an exclusive financing solution in a timely, efficient and effective way.

-

Reduce Administrative Burden

Receivables financing is easy to apply for when compared with bank loans as banks usually take more than one month to verify the creditworthiness of a firm. Through receivables financing, businesses can obtain cash flow quickly in a few steps.

-

Retain Business Ownership

Receivables financing allows firms to obtain working capital without the provision of collateral. This provides greater flexibility to firms in retaining their own assets. FundPark allows business to get funded in just a few steps without pledging your assets or collaterals.

-

Great Option for SMEs

Receivables financing is perfect for Small and Medium Enterprises (SMEs). FundPark looks into the potential growth of your business and provide immediate cash flow to secure business operation. Improve corporate’s cashflow sufficiency.

Why choose FundPark for Receivables Financing?

-

Experienced Management Team

Our team consists of experienced professionals from different industries including trade finance, commercial banking and information and technology etc.

-

Back Tested Proprietary Risk Model

Our self-developed risk credit model consists of parameters that enables dynamic data collection to provide SMEs with more efficient financing solutions in a shorter period of time, disrupting the complex structure of traditional financial institutions.

-

Digitalize Trade Finance Solutions with Technological Advancement

Our proprietary risk model connects API with different industry leading company’s databases that continuously improving credit model which facilitate the financing process.

-

Grow Business with SMEs

FundPark has provided trade financing solutions to hundreds of SMEs to optimize cash flow. We are committed to provide SMEs with reliable and trusted source of funding for them to optimize working capital.

-

Reliable and Trusted Source of Funding

Funders who are using the FundPark platform include the Global Fixed Income Fund, well-known asset management companies, Family Funds, and Hong Kong Main Board listed companies.

-

Strong Relationship with World’s Leading Strategic Partners

FundPark works with the world’s leading trade service providers and professional organizations to establish strategic partnerships with different organizations.

Apply for Receivables Financing Now!

Obtain cash flow in just a few steps without pledging your assets or collaterals if you are a Hong Kong listed B2B company with at least 1 year audit report.

【Apply Now】

About FundPark

Founded in 2016, FundPark is a trusted online trade finance platform in Asia striving to provide simple and effective solutions with innovative financial technologies to help corporates transform invoices and purchase orders into cash and improve corporate’s cashflow sufficiency. FundPark provides different supply chain financing solutions to corporates and innovative investment opportunities for institutional investors, commercial banks and other financial institutions.

To find out more about FundPark:

To find out more about FundPark:

Website: 👉🏻 www.fundpark.com

Email: 📧 [email protected]

Recent Article:

https://blog.fundpark.com/what-is-debt-factoring/

https://blog.fundpark.com/what-is-trade-finance/