What is Debt Factoring?An easy to understand guideline

Debt factoring, also known as invoice financing and invoice factoring, refers to the process when a business sells it accounts receivables to a debt factoring company. The debt factoring company pays for the invoice in advance so that the business can obtain immediate cash flows to finance its operation.

How does Debt Factoring work?

There are three parties involved in the debt factoring process: Seller, Buyer (accounts receivable) and debt factoring company.

Seller: The party who sells goods and services to Buyer.

Buyer (Accounts Receivable): The party who buys goods and services from a business.

Debt Factoring Company: The party who buys invoices from Buyer and pay it for a major percentage of the invoice value in advance.

Debt factoring takes place when Seller sells its accounts receivables at a discount rate to a debt factoring company.

Then, the debt factoring company will evaluate the financial health and reliability of the accounts receivables to determine the factoring agreement. The debt factoring company will pay the Seller in advance based on the factoring percentage.

After that, the debt factoring company will take full responsibility to collect payment from the Buyer.

At the end, the Seller will receive the remaining amount of invoice value, minus a factoring fee.

Benefits of Debt Factoring

-

Quick Access to Working Capital

Late paying clients might cause cash flow issues in the long run. Through debt factoring, businesses can convert accounts receivable into quick cash flows to finance their operation. Also, businesses can obtain quick capital to support their development and growth. FundPark allows businesses to obtain cash flow within 48 hours.

-

Easy to Apply

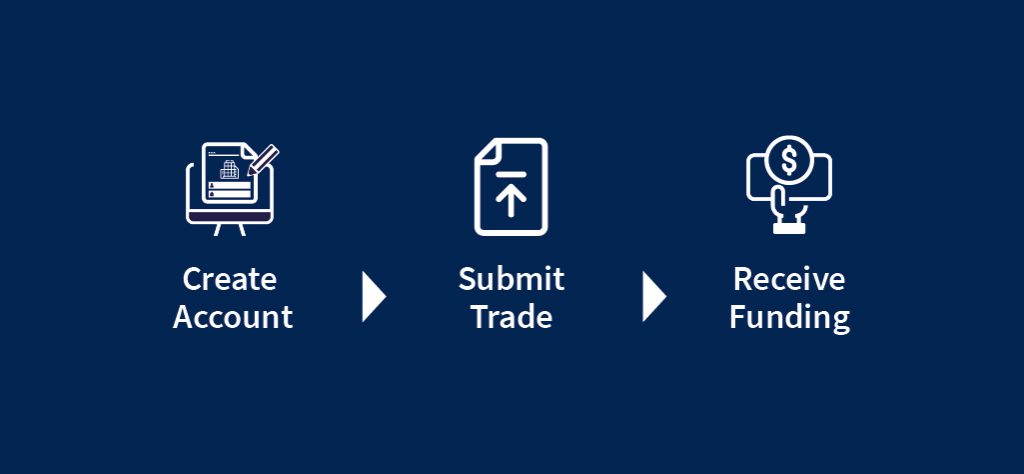

A business’s credit rating, presence of collateral and loan history are not the main factors in qualifying for debt factoring. Debt factoring companies only concerned with the payment history of a business’s accounts receivable. Also, debt factoring companies can determine the level of risk they are willing to take by the factoring percentage. Thus, debt factoring is much easier to apply for when compared with bank loans. FundPark allows business to get funded in just a few steps without pledging your assets or collaterals.

-

Retain Key Customers

Businesses can obtain adequate capital through debt factoring. This allows them to delay payment from key clients. It can help facilitate the long-term business relationship between businesses and key buyers.

-

Secure Business Ownership

Debt factoring allows businesses to obtain immediate cash flow without the provision of collateral. This provides greater flexibility to businesses in retaining their own assets.

Why choose FundPark for Debt Factoring?

-

Experienced Management Team

Our team consists of experienced professionals from different industries including trade finance, commercial banking and information and technology etc.

-

Back Tested Proprietary Risk Model

Our self-developed risk credit model consists of parameters that enables dynamic data collection to provide SMEs with more efficient financing solutions in a shorter period of time, disrupting the complex structure of traditional financial institutions.

-

Digitalize Trade Finance Solutions with Technological Advancement

Our proprietary risk model connects API with different industry leading company’s databases that continuously improving credit model which facilitate the financing process.

-

Grow Business with SMEs

FundPark has provided trade financing solutions to hundreds of SMEs to optimize cash flow. We are committed to provide SMEs with reliable and trusted source of funding for them to optimize working capital.

-

Reliable and Trusted Source of Funding

Funders who are using the FundPark platform include the Global Fixed Income Fund, well-known asset management companies, Family Funds, and Hong Kong Main Board listed companies.

-

Strong Relationship with World’s Leading Strategic Partners

FundPark works with the world’s leading trade service providers and professional organizations to establish strategic partnerships with different organizations.

Apply for Debt Factoring Now!

Obtain debt factoring in just a few steps without pledging your assets or collaterals if you are a Hong Kong listed B2B company with at least 1 year audit report.

【Apply Now】

About FundPark

Founded in 2016, FundPark is a trusted online trade finance platform in Asia striving to provide simple and effective solutions with innovative financial technologies to help corporates transform invoices and purchase orders into cash and improve corporate’s cashflow sufficiency. FundPark provides different supply chain financing solutions to corporates and innovative investment opportunities for institutional investors, commercial banks and other financial institutions.

To find out more about FundPark:

To find out more about FundPark:

Website: 👉🏻 www.fundpark.com

Email: 📧 [email protected]

Recent Article:

https://blog.fundpark.com/what-is-receivables-financing/

https://blog.fundpark.com/what-is-trade-finance/